Continuation from part – 1……

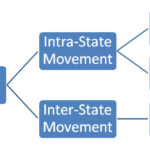

There are three types of GST in the whole system. The first one is CGST (Central Goods and Services Tax), second SGST (State Goods and Services Tax), and third IGST (Integrated Goods and Services Tax).

CGST और SGST दोनों को paisa 50-50 percent बाटा jata है l IGST directly Central Government ke pass जाता है l Central government IGST ka kuch hissa apne pass रखती है और बाकी State Governments bata जाता है l

CGST is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by CGST Act. Central Government apne हिस्से me आए hue revenue का 42% state ko as a Compensation ke तौर पर देती है l Compensation kyu? Jab se Government of India ne GST को introduce किया है तबसे State Government ka काफी revenue kam हो गया so, the central government gives 42% of what central government received. Central Government spends more money through Central Sponsored Schemes nearly 8-9 percent into the state. So after the calculation State Government approximately gets 80% and the remaining is retained by Central Government.

SGST is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST. इस revenue को use करनेकी authority state government की होती है l

IGST is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST is further distributed among state governments.

Click here to see the image in full size.

Slabs in GST

There are total 5 slabs in GST i.e. 0%, 5%, 12%, 18%, and 28%. GST council suggests changes in slabs to the Government of India. 2018 के protest के बाद sanitary napkin को 0% tax slab मे introduce किया गया l

No Tax (0%) = 7% of goods and services fall under this category. Some of there that are regular consumption include fresh fruits and vegetables🥗, milk🍼, buttermilk, curd, natural honey🍯, flour, etc.

5% Tax Slab = 14% of goods and services fall under this category. Some of these apparel below INR 1000 and footwear below INR 500, packed food items, cream skimmed milk powder, branded paneer, frozen vegetables, coffee☕️, tea🍵, spices🌶️, and much more.

12% Tax Slab = Edibles like frozen meat products🍖, butter, cheese🧀, ghee, dry fruits in packaged form, animal fat sausages, fruits juices🍹, namkeen, ketchup and sauces, ayurvedic medicine, all diagnostic kits and reagents, cellphones📱, spoons, forks, etc. are included in this category.

18% Tax Slab = 43% of goods and services fall under this category. Pasta, biscuits🍪, cornflakes, pastries and cakes🍰, preserved vegetables, jams, soups, ice cream🍨, mayonnaise, mixed condiments and seasoning, mineral water, footwear costing more than INR 500, camera, speaker, monitors, printers, and much more are included in this category.

28% Tax Slab = 19% of goods and services fall under this category. The rest of edibles like chewing gum, bidi, molasses, chocolate not containing cocoa, waffles, and wafers coated with chocolates, aerated water, water heater, private lottery, and movie tickets above INR 100, etc. have been clubbed together under the 28% GST slab.

Some goods like Petroleum products, alcohol for human consumption, etc are not included yet.

Concerns about GST

As from the whole, we understand that 50-50% GST central और state government ko मिलता है l Central government मिले हुए paiso मे से 42% state ko transfer करती है इसे Tax Devolution kaha जाता है l 2013 मे 14th Finance Commission ne यह recommend किया था l Issilye हम assume kar सकते है कि हमारा paisa यहां जाता होगा l Lekin aisa hona काफी मुश्किल है l GST ko implement karne ke bad सबसे बड़ी revenue problems state government ko hua. State ke pass revenue kam था issilye as a compensation Central Government ने state government को दो choices दिए l

1) State can borrow ₹97 thousand crores from the special provision of the central government.

2) State can borrow ₹2.35 lakh crores with interest from the central government.

State government ko अपने ही paiso के लिए loan lena पड़ रहा है l Issi तरह same situation Central Sponsored Scheme की है जहा Indian budget me इसकी कोई जगह नहीं है aur state government ke pass koi revenue नहीं है l

GST के वजहसे small traders ko काफी तकलीफ उठानी पड़ी l Issi वजह से kafi businesses बंद हुए l GST creates confusion among traders. GST यह tax desh ka सबसे बड़ा tax reform था issiliye GST ke sahi implementation और जादा time लगेगा l Otherwise aap iss tax के bareme kya views rakhte ho hame जरूर बताए l There are some suggestions from Acharya Chanakya below.

Suggestions from Acharya Chanakya🤔

• Taxation should not be a painful process for the people.

• There should be leniency and caution while deciding the tax structure.

• Ideally, governments should collect taxes like a honey bee, which sucks just the right amount of honey so that both can survive.

• Taxes should be collected in small and not in large proportions.

ll 🙏🏻 धन्यवाद 🙏🏻 ll

– j₹k

2,949 Comments

Sexy · April 25, 2024 at 3:11 AM

Hi there! I know this is kinda off topic however , I’d figured I’d ask.

Would you be interested in trading links or maybe guest authoring a blog article or vice-versa?

My site goes over a lot of the same subjects as yours and I believe we could greatly benefit from each other.

If you are interested feel free to send me an email.

I look forward to hearing from you! Great blog by the way!

Průmyslové obrábění · April 24, 2024 at 2:38 PM

I’m not that much of a online reader to be honest but your

blogs really nice, keep it up! I’ll go ahead and bookmark your website to come back later.

All the best

Weight Loss · April 24, 2024 at 10:06 AM

This is the right webpage for everyone who hopes to understand this

topic. You understand a whole lot its almost hard to argue with you (not that I actually would

want to…HaHa). You certainly put a new spin on a topic that’s been written about for a long time.

Wonderful stuff, just wonderful!

Cedrick Lisherness · April 21, 2024 at 10:41 AM

Aw, this was a very nice post. In thought I wish to put in writing like this moreover – taking time and precise effort to make an excellent article… however what can I say… I procrastinate alot and in no way seem to get one thing done.

tunas daihatsu cinere sawah besar · April 20, 2024 at 7:31 PM

Greetings! Very helpful advice within this post! It is

the little changes that will make the most

important changes. Many thanks for sharing!

hdfilmcehennemi · April 16, 2024 at 12:31 PM

Fullhdfilmizlesene ile en yeni vizyon filmler Full HD ve ücretsiz film sizlerle. Orijinal film arşivimizle en kaliteli film izle fırsatı sunuyoruz. Dwayne Eperson

https://xparkles.com · April 16, 2024 at 9:56 AM

Exccellent post. I was checking continuously this weblog

and I am impressed! Very useful info particularly the closing phase 🙂 I mainntain sucxh info a lot.

I was seeking this particular info for a long time. Thanks and good luck.

Feel free to surf to my web site … Leather Dog Collar (https://xparkles.com)

praca kierowca kanada · April 14, 2024 at 3:58 PM

Because bridge financing tends to be more expensive than other types of financing, it

is generally a good idea to determine if it is possible to borrow money from other sources.

If the recent trends in lending are to be believed, lenders are not as cautious

about lending to the people with bad credit.

You can get what is called a payday loan or cash advance to

help you get out of a jam.

praca za granica magazynier · April 14, 2024 at 3:42 PM

Hello there, I found your blog by way of Google while searching for a related

subject, your web site came up, it looks good.

I’ve bookmarked it in my google bookmarks.

Hi there, simply turned into alert to your blog thru Google, and

found that it’s really informative. I’m going to

be careful for brussels. I’ll appreciate in the event you continue

this in future. Lots of people will be benefited from your writing.

Cheers!

Hugo Hagy · April 13, 2024 at 10:54 PM

I am continuously browsing online for posts that can assist me. Thx!

RENEW · April 13, 2024 at 10:22 AM

https://renewsaltwatertrick.com/

6612a34d20096.site123.me · April 11, 2024 at 3:21 PM

It’s the best time to make some plans for the future and it

is time to be happy. I have read thiss post annd if I

could I desiree to suggest you feew interesting things or suggestions.

Perhaps you can wwrite next articles referring to this article.

I desire tto read even more things about it!

Take a look at my web blog … sezonowa praca w holandii [6612a34d20096.site123.me]

best friends forever melanie and natalee share a dick in 1st porn casting! · April 10, 2024 at 5:28 AM

hello there and thank you for your info – I’ve certainly

picked up something new from right here. I did however expertise some technical points using this website, as

I experienced to reload the site many times previous to I could

get it to load correctly. I had been wondering if your

hosting is OK? Not that I am complaining, but sluggish loading

instances times will often affect your placement in google and could damage your high-quality score

if advertising and marketing with Adwords. Anyway I am adding this RSS to

my e-mail and could look out for a lot more of your respective interesting content.

Make sure you update this again soon.

dam pracę tarnów · April 9, 2024 at 7:33 AM

If you are going for best contents like myself, only pay a visit

this website all the time for the reason that it

offers quality contents, thanks

My web page; dam pracę tarnów

praca na wieczory · April 8, 2024 at 12:47 PM

Doess your site have a contact page? I’m having problems locating

it but, I’d like to shoot you an e-mail. I’ve got some creativge ideas for your blog yyou might be interested in hearing.

Either way, great website and I look forwasrd to seeing it

grow over time.

Here is my web blog – praca na wieczory

telegra.ph · April 8, 2024 at 9:48 AM

hello!,I really like your writing very so much! share we keep in touch more approximately your article on AOL?

I require a specialist in this house to solve my problem.

Maybee that is you! Taking a look forward to look you.

My webpage – praca na fuerteventura; telegra.ph,

darmowe ogłoszenia zakopane · April 7, 2024 at 12:29 PM

Good day! This is kind of off topic but I need some

help from an established blog. Is it hard to set up your

own blog? I’m not very techincal but I can figure things

out pretty fast. I’m thinking about creating my own but I’m not

sure where to begin. Do you have any tips or suggestions?

With thanks

praca lakiernik lubelskie · April 7, 2024 at 11:36 AM

Hi there, yup this post is in fact good and I have learned lot of things

from it concerning blogging. thanks.

mpo8080 · April 7, 2024 at 10:58 AM

I constantly emailed this blog post page to all

my contacts, because if like to read it next my friends will too.

링크모음 · April 7, 2024 at 5:46 AM

Howdy! I understand this iis somewhat off-topic but I

haad to ask. Does running a well-established websit like yours require a massive amount work?

I’m brand new to blogging buut I do wrtite in my journal on a daily basis.

I’d like to start a blog so I can easily share my perzonal experience and views online.

Please let me know if yoou hae any ideas or

tips for new aspiring blog owners. Thankyou!

My webpagge :: 링크모음