Continuation from part – 1……

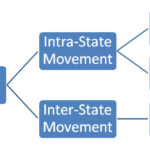

There are three types of GST in the whole system. The first one is CGST (Central Goods and Services Tax), second SGST (State Goods and Services Tax), and third IGST (Integrated Goods and Services Tax).

CGST और SGST दोनों को paisa 50-50 percent बाटा jata है l IGST directly Central Government ke pass जाता है l Central government IGST ka kuch hissa apne pass रखती है और बाकी State Governments bata जाता है l

CGST is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by CGST Act. Central Government apne हिस्से me आए hue revenue का 42% state ko as a Compensation ke तौर पर देती है l Compensation kyu? Jab se Government of India ne GST को introduce किया है तबसे State Government ka काफी revenue kam हो गया so, the central government gives 42% of what central government received. Central Government spends more money through Central Sponsored Schemes nearly 8-9 percent into the state. So after the calculation State Government approximately gets 80% and the remaining is retained by Central Government.

SGST is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST. इस revenue को use करनेकी authority state government की होती है l

IGST is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST is further distributed among state governments.

Click here to see the image in full size.

Slabs in GST

There are total 5 slabs in GST i.e. 0%, 5%, 12%, 18%, and 28%. GST council suggests changes in slabs to the Government of India. 2018 के protest के बाद sanitary napkin को 0% tax slab मे introduce किया गया l

No Tax (0%) = 7% of goods and services fall under this category. Some of there that are regular consumption include fresh fruits and vegetables🥗, milk🍼, buttermilk, curd, natural honey🍯, flour, etc.

5% Tax Slab = 14% of goods and services fall under this category. Some of these apparel below INR 1000 and footwear below INR 500, packed food items, cream skimmed milk powder, branded paneer, frozen vegetables, coffee☕️, tea🍵, spices🌶️, and much more.

12% Tax Slab = Edibles like frozen meat products🍖, butter, cheese🧀, ghee, dry fruits in packaged form, animal fat sausages, fruits juices🍹, namkeen, ketchup and sauces, ayurvedic medicine, all diagnostic kits and reagents, cellphones📱, spoons, forks, etc. are included in this category.

18% Tax Slab = 43% of goods and services fall under this category. Pasta, biscuits🍪, cornflakes, pastries and cakes🍰, preserved vegetables, jams, soups, ice cream🍨, mayonnaise, mixed condiments and seasoning, mineral water, footwear costing more than INR 500, camera, speaker, monitors, printers, and much more are included in this category.

28% Tax Slab = 19% of goods and services fall under this category. The rest of edibles like chewing gum, bidi, molasses, chocolate not containing cocoa, waffles, and wafers coated with chocolates, aerated water, water heater, private lottery, and movie tickets above INR 100, etc. have been clubbed together under the 28% GST slab.

Some goods like Petroleum products, alcohol for human consumption, etc are not included yet.

Concerns about GST

As from the whole, we understand that 50-50% GST central और state government ko मिलता है l Central government मिले हुए paiso मे से 42% state ko transfer करती है इसे Tax Devolution kaha जाता है l 2013 मे 14th Finance Commission ne यह recommend किया था l Issilye हम assume kar सकते है कि हमारा paisa यहां जाता होगा l Lekin aisa hona काफी मुश्किल है l GST ko implement karne ke bad सबसे बड़ी revenue problems state government ko hua. State ke pass revenue kam था issilye as a compensation Central Government ने state government को दो choices दिए l

1) State can borrow ₹97 thousand crores from the special provision of the central government.

2) State can borrow ₹2.35 lakh crores with interest from the central government.

State government ko अपने ही paiso के लिए loan lena पड़ रहा है l Issi तरह same situation Central Sponsored Scheme की है जहा Indian budget me इसकी कोई जगह नहीं है aur state government ke pass koi revenue नहीं है l

GST के वजहसे small traders ko काफी तकलीफ उठानी पड़ी l Issi वजह से kafi businesses बंद हुए l GST creates confusion among traders. GST यह tax desh ka सबसे बड़ा tax reform था issiliye GST ke sahi implementation और जादा time लगेगा l Otherwise aap iss tax के bareme kya views rakhte ho hame जरूर बताए l There are some suggestions from Acharya Chanakya below.

Suggestions from Acharya Chanakya🤔

• Taxation should not be a painful process for the people.

• There should be leniency and caution while deciding the tax structure.

• Ideally, governments should collect taxes like a honey bee, which sucks just the right amount of honey so that both can survive.

• Taxes should be collected in small and not in large proportions.

ll 🙏🏻 धन्यवाद 🙏🏻 ll

– j₹k

2,996 Comments

포커 · May 7, 2024 at 11:09 PM

Hello Dear, are you in fact visiting this website on a regular basis, if

so then you will absolutely get nice know-how.

Delbert Kurtis · May 7, 2024 at 5:32 AM

I am really inspired together with your writing abilities as well as with the layout to your blog. Is this a paid subject matter or did you customize it yourself? Anyway keep up the nice high quality writing, it’s rare to peer a nice weblog like this one today..

티비다시보기 · May 6, 2024 at 6:21 PM

Your platform has been a true revelation for me. The depth of insights and the clarity of presentation have made learning a joyous experience. Thank you for sharing your expertise and making a positive impact on countless lives!

couple porn · May 5, 2024 at 10:51 PM

Hello, i read your blog occasionally and i own a similar one and i was just curious if you get a

lot of spam feedback? If so how do you stop it, any plugin or anything you can advise?

I get so much lately it’s driving me mad so any support is very much appreciated.

https://bit.ly/3JNlUD6

sillon · May 5, 2024 at 10:41 AM

Thanks for every other wonderful post. Where else may anybody

get that type of information in such a perfect manner of writing?

I’ve a presentation subsequent week, and I’m at

the look for such info.

Keygen · May 5, 2024 at 7:44 AM

I go to see everyday some websites and sites to read articles or reviews,

however this blog presents feature based posts.

tvbrackets · May 4, 2024 at 1:38 PM

What i dont understood is in reality how youre now not really a lot more smartlyfavored than you might be now Youre very intelligent You understand therefore significantly in terms of this topic produced me personally believe it from a lot of numerous angles Its like women and men are not interested except it is one thing to accomplish with Woman gaga Your own stuffs outstanding Always care for it up

Human · May 4, 2024 at 9:23 AM

Hi! This is kind of off topic but I need some help from an established blog.

Is it very hard to set up your own blog? I’m not very techincal

but I can figure things out pretty fast. I’m thinking about

setting up my own but I’m not sure where to begin. Do you have any ideas or suggestions?

Cheers

acheteriptvabonnement · May 3, 2024 at 12:23 PM

of course like your website but you have to check the spelling on several of your posts A number of them are rife with spelling issues and I in finding it very troublesome to inform the reality on the other hand I will certainly come back again

porn videos · May 2, 2024 at 1:36 PM

Thanks for another informative web site.

The place else could I am getting that kind of info written in such a perfect method?

I’ve a mission that I’m simply now running on, and I’ve been on the look out for such info.

cbn grinding wheel suppliers · May 1, 2024 at 10:34 PM

I don’t even know how I ended up here, but

I thought this post was great. I don’t know who

you are but certainly you are going to a famous blogger

if you are not already 😉 Cheers!

pilllow · May 1, 2024 at 3:04 PM

I am not sure where youre getting your info but good topic I needs to spend some time learning much more or understanding more Thanks for magnificent info I was looking for this information for my mission

porn videos · April 30, 2024 at 10:05 PM

Hello to every one, the contents present at this website are truly remarkable for people

knowledge, well, keep up the good work fellows.

praca kielce · April 29, 2024 at 2:01 PM

You could dedfinitely seee your expertise in the work you write.

The sector hopes for more passionate writers like you who aren’t

afraid to say how they believe. Always go after your heart.

Stop by my blog post: praca kielce

roof sheet rolling machine · April 28, 2024 at 4:40 PM

Hi there everyone, it’s my first pay a quick visit

at this web site, and post is genuinely fruitful in favor of me, keep up posting these articles or reviews.

visual craft · April 28, 2024 at 5:18 AM

Today, I went to the beach front with my children. I found a sea

shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.”

She put the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear. She never

wants to go back! LoL I know this is completely off topic but I had to tell

someone!

demystifying-the-shein-supply-chain-breaking-the-magic-of-fast-fashion-giants-can-temu-be-defeated-now · April 27, 2024 at 5:48 PM

Right here is the perfect website for anyone who really wants to find out about this topic.

You understand a whole lot its almost tough to argue with you (not that I personally will need to…HaHa).

You certainly put a new spin on a subject that’s been written about for ages.

Excellent stuff, just great!

electroplated diamond grinding wheels · April 27, 2024 at 1:06 PM

I’m curious to find out what blog platform you’re utilizing?

I’m experiencing some small security issues with my latest blog and I’d like to find something more risk-free.

Do you have any solutions?

hd porn · April 26, 2024 at 12:36 PM

Ahaa, its nice dialogue concerning this article at this

place at this webpage, I have read all that, so at this time me also commenting at this place.

Registro de binance · April 26, 2024 at 11:12 AM

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.