Continuation from part – 1……

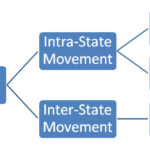

There are three types of GST in the whole system. The first one is CGST (Central Goods and Services Tax), second SGST (State Goods and Services Tax), and third IGST (Integrated Goods and Services Tax).

CGST और SGST दोनों को paisa 50-50 percent बाटा jata है l IGST directly Central Government ke pass जाता है l Central government IGST ka kuch hissa apne pass रखती है और बाकी State Governments bata जाता है l

CGST is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by CGST Act. Central Government apne हिस्से me आए hue revenue का 42% state ko as a Compensation ke तौर पर देती है l Compensation kyu? Jab se Government of India ne GST को introduce किया है तबसे State Government ka काफी revenue kam हो गया so, the central government gives 42% of what central government received. Central Government spends more money through Central Sponsored Schemes nearly 8-9 percent into the state. So after the calculation State Government approximately gets 80% and the remaining is retained by Central Government.

SGST is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST. इस revenue को use करनेकी authority state government की होती है l

IGST is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST is further distributed among state governments.

Click here to see the image in full size.

Slabs in GST

There are total 5 slabs in GST i.e. 0%, 5%, 12%, 18%, and 28%. GST council suggests changes in slabs to the Government of India. 2018 के protest के बाद sanitary napkin को 0% tax slab मे introduce किया गया l

No Tax (0%) = 7% of goods and services fall under this category. Some of there that are regular consumption include fresh fruits and vegetables🥗, milk🍼, buttermilk, curd, natural honey🍯, flour, etc.

5% Tax Slab = 14% of goods and services fall under this category. Some of these apparel below INR 1000 and footwear below INR 500, packed food items, cream skimmed milk powder, branded paneer, frozen vegetables, coffee☕️, tea🍵, spices🌶️, and much more.

12% Tax Slab = Edibles like frozen meat products🍖, butter, cheese🧀, ghee, dry fruits in packaged form, animal fat sausages, fruits juices🍹, namkeen, ketchup and sauces, ayurvedic medicine, all diagnostic kits and reagents, cellphones📱, spoons, forks, etc. are included in this category.

18% Tax Slab = 43% of goods and services fall under this category. Pasta, biscuits🍪, cornflakes, pastries and cakes🍰, preserved vegetables, jams, soups, ice cream🍨, mayonnaise, mixed condiments and seasoning, mineral water, footwear costing more than INR 500, camera, speaker, monitors, printers, and much more are included in this category.

28% Tax Slab = 19% of goods and services fall under this category. The rest of edibles like chewing gum, bidi, molasses, chocolate not containing cocoa, waffles, and wafers coated with chocolates, aerated water, water heater, private lottery, and movie tickets above INR 100, etc. have been clubbed together under the 28% GST slab.

Some goods like Petroleum products, alcohol for human consumption, etc are not included yet.

Concerns about GST

As from the whole, we understand that 50-50% GST central और state government ko मिलता है l Central government मिले हुए paiso मे से 42% state ko transfer करती है इसे Tax Devolution kaha जाता है l 2013 मे 14th Finance Commission ne यह recommend किया था l Issilye हम assume kar सकते है कि हमारा paisa यहां जाता होगा l Lekin aisa hona काफी मुश्किल है l GST ko implement karne ke bad सबसे बड़ी revenue problems state government ko hua. State ke pass revenue kam था issilye as a compensation Central Government ने state government को दो choices दिए l

1) State can borrow ₹97 thousand crores from the special provision of the central government.

2) State can borrow ₹2.35 lakh crores with interest from the central government.

State government ko अपने ही paiso के लिए loan lena पड़ रहा है l Issi तरह same situation Central Sponsored Scheme की है जहा Indian budget me इसकी कोई जगह नहीं है aur state government ke pass koi revenue नहीं है l

GST के वजहसे small traders ko काफी तकलीफ उठानी पड़ी l Issi वजह से kafi businesses बंद हुए l GST creates confusion among traders. GST यह tax desh ka सबसे बड़ा tax reform था issiliye GST ke sahi implementation और जादा time लगेगा l Otherwise aap iss tax के bareme kya views rakhte ho hame जरूर बताए l There are some suggestions from Acharya Chanakya below.

Suggestions from Acharya Chanakya🤔

• Taxation should not be a painful process for the people.

• There should be leniency and caution while deciding the tax structure.

• Ideally, governments should collect taxes like a honey bee, which sucks just the right amount of honey so that both can survive.

• Taxes should be collected in small and not in large proportions.

ll 🙏🏻 धन्यवाद 🙏🏻 ll

– j₹k

2,949 Comments

kompas138 · August 6, 2023 at 7:11 PM

naturally like your website but you have to test the spelling on several of your posts. Many of them are rife with spelling issues and I to find it very bothersome to tell the reality on the other hand I’ll certainly come back again.

Bulk Weed · August 6, 2023 at 3:36 PM

I used to be very happy to search out this net-site.I wished to thanks in your time for this excellent read!! I positively enjoying every little bit of it and I’ve you bookmarked to take a look at new stuff you blog post.

hosting kalimantan selatan · August 6, 2023 at 7:54 AM

It’s actually a nice and useful piece of info. I am glad that you shared this helpful information with us. Please keep us informed like this. Thanks for sharing.

kirim motor bandung jakarta · August 6, 2023 at 7:16 AM

Excellent beat ! I wish to apprentice while you amend your site, how could i subscribe for a blog web site? The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear idea

carro usado a venda · August 6, 2023 at 4:08 AM

Good day very nice site!! Man .. Excellent .. Amazing .. I’ll bookmark your site and take the feeds additionally…I am satisfied to search out numerous helpful info here in the submit, we’d like work out more techniques in this regard, thanks for sharing.

ftmo funded account · August 5, 2023 at 6:07 PM

With havin so much content and articles do you ever run into any problems of plagorism or copyright violation? My blog has a lot of completely unique content I’ve either created myself or outsourced but it looks like a lot of it is popping it up all over the internet without my authorization. Do you know any methods to help prevent content from being ripped off? I’d certainly appreciate it.

Βάψιμο σπιτιού · August 5, 2023 at 2:53 AM

Pretty great post. I simply stumbled upon your blog and wanted to mention that I’ve truly enjoyed browsing your blog posts. After all I’ll be subscribing for your feed and I am hoping you write once more soon!

pragmatic555 slot · August 4, 2023 at 8:02 PM

Hi there, I discovered your site by the use of Google even as looking for a comparable topic, your site got here up, it looks good. I’ve bookmarked it in my google bookmarks.

mpo100 slot · August 4, 2023 at 5:12 PM

I am glad to be a visitor of this staring web blog! , thanks for this rare information! .

painel smm · August 4, 2023 at 2:26 PM

Hello there, just became alert to your blog through Google, and found that it’s really informative. I’m gonna watch out for brussels. I’ll appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Conserto de ar condicionado em sp · August 4, 2023 at 1:27 PM

Wonderful blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Appreciate it

circulation pumps for hot tubs · August 4, 2023 at 1:22 PM

Perfectly composed content material, Really enjoyed looking at.

cheapweed · August 3, 2023 at 3:43 PM

I¦ve recently started a site, the information you offer on this site has helped me tremendously. Thanks for all of your time & work.

Kampung Inggris · August 3, 2023 at 12:37 PM

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

Kursus IELTS Online · August 3, 2023 at 10:35 AM

Hola! I’ve been following your blog for some time now and finally got the bravery to go ahead and give you a shout out from Houston Texas! Just wanted to tell you keep up the fantastic job!

Kursus TOEFL Online · August 3, 2023 at 8:57 AM

You have mentioned very interesting details! ps decent web site. “We simply rob ourselves when we make presents to the dead.” by Publilius Syrus.

Kursus IELTS · August 3, 2023 at 5:38 AM

Hello! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the excellent work!

Kursus TOEFL · August 3, 2023 at 4:23 AM

Whats Taking place i am new to this, I stumbled upon this I’ve discovered It positively helpful and it has helped me out loads. I am hoping to contribute & aid different customers like its aided me. Great job.

Kursus Bahasa Inggris Online · August 3, 2023 at 2:43 AM

I got good info from your blog

Kursus Bahasa Inggris · August 3, 2023 at 12:03 AM

Awsome website! I am loving it!! Will be back later to read some more. I am taking your feeds also.