Continuation from part – 1……

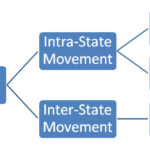

There are three types of GST in the whole system. The first one is CGST (Central Goods and Services Tax), second SGST (State Goods and Services Tax), and third IGST (Integrated Goods and Services Tax).

CGST और SGST दोनों को paisa 50-50 percent बाटा jata है l IGST directly Central Government ke pass जाता है l Central government IGST ka kuch hissa apne pass रखती है और बाकी State Governments bata जाता है l

CGST is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by CGST Act. Central Government apne हिस्से me आए hue revenue का 42% state ko as a Compensation ke तौर पर देती है l Compensation kyu? Jab se Government of India ne GST को introduce किया है तबसे State Government ka काफी revenue kam हो गया so, the central government gives 42% of what central government received. Central Government spends more money through Central Sponsored Schemes nearly 8-9 percent into the state. So after the calculation State Government approximately gets 80% and the remaining is retained by Central Government.

SGST is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST. इस revenue को use करनेकी authority state government की होती है l

IGST is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST is further distributed among state governments.

Click here to see the image in full size.

Slabs in GST

There are total 5 slabs in GST i.e. 0%, 5%, 12%, 18%, and 28%. GST council suggests changes in slabs to the Government of India. 2018 के protest के बाद sanitary napkin को 0% tax slab मे introduce किया गया l

No Tax (0%) = 7% of goods and services fall under this category. Some of there that are regular consumption include fresh fruits and vegetables🥗, milk🍼, buttermilk, curd, natural honey🍯, flour, etc.

5% Tax Slab = 14% of goods and services fall under this category. Some of these apparel below INR 1000 and footwear below INR 500, packed food items, cream skimmed milk powder, branded paneer, frozen vegetables, coffee☕️, tea🍵, spices🌶️, and much more.

12% Tax Slab = Edibles like frozen meat products🍖, butter, cheese🧀, ghee, dry fruits in packaged form, animal fat sausages, fruits juices🍹, namkeen, ketchup and sauces, ayurvedic medicine, all diagnostic kits and reagents, cellphones📱, spoons, forks, etc. are included in this category.

18% Tax Slab = 43% of goods and services fall under this category. Pasta, biscuits🍪, cornflakes, pastries and cakes🍰, preserved vegetables, jams, soups, ice cream🍨, mayonnaise, mixed condiments and seasoning, mineral water, footwear costing more than INR 500, camera, speaker, monitors, printers, and much more are included in this category.

28% Tax Slab = 19% of goods and services fall under this category. The rest of edibles like chewing gum, bidi, molasses, chocolate not containing cocoa, waffles, and wafers coated with chocolates, aerated water, water heater, private lottery, and movie tickets above INR 100, etc. have been clubbed together under the 28% GST slab.

Some goods like Petroleum products, alcohol for human consumption, etc are not included yet.

Concerns about GST

As from the whole, we understand that 50-50% GST central और state government ko मिलता है l Central government मिले हुए paiso मे से 42% state ko transfer करती है इसे Tax Devolution kaha जाता है l 2013 मे 14th Finance Commission ne यह recommend किया था l Issilye हम assume kar सकते है कि हमारा paisa यहां जाता होगा l Lekin aisa hona काफी मुश्किल है l GST ko implement karne ke bad सबसे बड़ी revenue problems state government ko hua. State ke pass revenue kam था issilye as a compensation Central Government ने state government को दो choices दिए l

1) State can borrow ₹97 thousand crores from the special provision of the central government.

2) State can borrow ₹2.35 lakh crores with interest from the central government.

State government ko अपने ही paiso के लिए loan lena पड़ रहा है l Issi तरह same situation Central Sponsored Scheme की है जहा Indian budget me इसकी कोई जगह नहीं है aur state government ke pass koi revenue नहीं है l

GST के वजहसे small traders ko काफी तकलीफ उठानी पड़ी l Issi वजह से kafi businesses बंद हुए l GST creates confusion among traders. GST यह tax desh ka सबसे बड़ा tax reform था issiliye GST ke sahi implementation और जादा time लगेगा l Otherwise aap iss tax के bareme kya views rakhte ho hame जरूर बताए l There are some suggestions from Acharya Chanakya below.

Suggestions from Acharya Chanakya🤔

• Taxation should not be a painful process for the people.

• There should be leniency and caution while deciding the tax structure.

• Ideally, governments should collect taxes like a honey bee, which sucks just the right amount of honey so that both can survive.

• Taxes should be collected in small and not in large proportions.

ll 🙏🏻 धन्यवाद 🙏🏻 ll

– j₹k

2,996 Comments

slot gacor hari ini · August 15, 2023 at 11:12 PM

As a Newbie, I am permanently browsing online for articles that can help me. Thank you

jumbototo · August 15, 2023 at 8:52 PM

I was recommended this web site by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about my trouble. You are incredible! Thanks!

slot dana · August 15, 2023 at 5:14 PM

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

rajaslot88 · August 15, 2023 at 1:59 PM

Hello! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in trading links or maybe guest authoring a blog post or vice-versa? My site covers a lot of the same subjects as yours and I think we could greatly benefit from each other. If you happen to be interested feel free to shoot me an email. I look forward to hearing from you! Excellent blog by the way!

link rajaslot88 · August 15, 2023 at 12:49 PM

Some truly fantastic information, Sword lily I found this. “The Diplomat sits in silence, watching the world with his ears.” by Leon Samson.

home solar system quote · August 15, 2023 at 11:03 AM

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

Services de dératisation résidentielle · August 14, 2023 at 8:58 PM

Its good as your other posts : D, regards for posting. “To be able to look back upon ones life in satisfaction, is to live twice.” by Kahlil Gibran.

Services de dératisation professionnelle · August 14, 2023 at 6:44 PM

I too conceive therefore, perfectly composed post! .

private investigation services · August 14, 2023 at 11:24 AM

I have recently started a website, the info you offer on this web site has helped me greatly. Thanks for all of your time & work.

fb auto liker · August 14, 2023 at 11:23 AM

Great blog! Do you have any tips and hints for aspiring writers? I’m planning to start my own website soon but I’m a little lost on everything. Would you advise starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m totally overwhelmed .. Any suggestions? Thanks a lot!

hire a hacker for cell phone · August 14, 2023 at 9:43 AM

I regard something genuinely interesting about your weblog so I saved to my bookmarks.

hackers for hire roblox · August 14, 2023 at 6:41 AM

Needed to send you that very small word to help say thanks a lot the moment again about the splendid suggestions you’ve featured in this article. It has been simply tremendously open-handed with you to convey without restraint all a number of people could have distributed for an e book to get some money for themselves, particularly given that you could have done it in the event you wanted. The tips in addition worked to provide a easy way to fully grasp the rest have similar keenness just like my own to know whole lot more when considering this matter. I know there are many more enjoyable opportunities in the future for people who find out your blog.

ligaciputra77 · August 14, 2023 at 12:41 AM

I too believe therefore, perfectly written post! .

alquiler mercedes vito valencia · August 13, 2023 at 11:52 PM

I got good info from your blog

ngamenslot · August 13, 2023 at 10:45 PM

I’ve recently started a site, the info you offer on this site has helped me tremendously. Thank you for all of your time & work.

Calentar agua piscina · August 13, 2023 at 7:03 PM

Some times its a pain in the ass to read what people wrote but this web site is very user friendly! .

hidroximetilación · August 13, 2023 at 4:12 PM

Hi, I think your site might be having browser compatibility issues. When I look at your blog site in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, excellent blog!

Eurocasino · August 12, 2023 at 9:10 PM

I enjoy the efforts you have put in this, regards for all the great blog posts.

European Casino · August 12, 2023 at 7:12 PM

Very interesting info!Perfect just what I was searching for!

European Casinos · August 12, 2023 at 5:16 PM

Excellent beat ! I wish to apprentice while you amend your website, how can i subscribe for a blog website? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear idea