Continuation from part – 1……

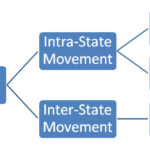

There are three types of GST in the whole system. The first one is CGST (Central Goods and Services Tax), second SGST (State Goods and Services Tax), and third IGST (Integrated Goods and Services Tax).

CGST और SGST दोनों को paisa 50-50 percent बाटा jata है l IGST directly Central Government ke pass जाता है l Central government IGST ka kuch hissa apne pass रखती है और बाकी State Governments bata जाता है l

CGST is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by CGST Act. Central Government apne हिस्से me आए hue revenue का 42% state ko as a Compensation ke तौर पर देती है l Compensation kyu? Jab se Government of India ne GST को introduce किया है तबसे State Government ka काफी revenue kam हो गया so, the central government gives 42% of what central government received. Central Government spends more money through Central Sponsored Schemes nearly 8-9 percent into the state. So after the calculation State Government approximately gets 80% and the remaining is retained by Central Government.

SGST is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST. इस revenue को use करनेकी authority state government की होती है l

IGST is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST is further distributed among state governments.

Click here to see the image in full size.

Slabs in GST

There are total 5 slabs in GST i.e. 0%, 5%, 12%, 18%, and 28%. GST council suggests changes in slabs to the Government of India. 2018 के protest के बाद sanitary napkin को 0% tax slab मे introduce किया गया l

No Tax (0%) = 7% of goods and services fall under this category. Some of there that are regular consumption include fresh fruits and vegetables🥗, milk🍼, buttermilk, curd, natural honey🍯, flour, etc.

5% Tax Slab = 14% of goods and services fall under this category. Some of these apparel below INR 1000 and footwear below INR 500, packed food items, cream skimmed milk powder, branded paneer, frozen vegetables, coffee☕️, tea🍵, spices🌶️, and much more.

12% Tax Slab = Edibles like frozen meat products🍖, butter, cheese🧀, ghee, dry fruits in packaged form, animal fat sausages, fruits juices🍹, namkeen, ketchup and sauces, ayurvedic medicine, all diagnostic kits and reagents, cellphones📱, spoons, forks, etc. are included in this category.

18% Tax Slab = 43% of goods and services fall under this category. Pasta, biscuits🍪, cornflakes, pastries and cakes🍰, preserved vegetables, jams, soups, ice cream🍨, mayonnaise, mixed condiments and seasoning, mineral water, footwear costing more than INR 500, camera, speaker, monitors, printers, and much more are included in this category.

28% Tax Slab = 19% of goods and services fall under this category. The rest of edibles like chewing gum, bidi, molasses, chocolate not containing cocoa, waffles, and wafers coated with chocolates, aerated water, water heater, private lottery, and movie tickets above INR 100, etc. have been clubbed together under the 28% GST slab.

Some goods like Petroleum products, alcohol for human consumption, etc are not included yet.

Concerns about GST

As from the whole, we understand that 50-50% GST central और state government ko मिलता है l Central government मिले हुए paiso मे से 42% state ko transfer करती है इसे Tax Devolution kaha जाता है l 2013 मे 14th Finance Commission ne यह recommend किया था l Issilye हम assume kar सकते है कि हमारा paisa यहां जाता होगा l Lekin aisa hona काफी मुश्किल है l GST ko implement karne ke bad सबसे बड़ी revenue problems state government ko hua. State ke pass revenue kam था issilye as a compensation Central Government ने state government को दो choices दिए l

1) State can borrow ₹97 thousand crores from the special provision of the central government.

2) State can borrow ₹2.35 lakh crores with interest from the central government.

State government ko अपने ही paiso के लिए loan lena पड़ रहा है l Issi तरह same situation Central Sponsored Scheme की है जहा Indian budget me इसकी कोई जगह नहीं है aur state government ke pass koi revenue नहीं है l

GST के वजहसे small traders ko काफी तकलीफ उठानी पड़ी l Issi वजह से kafi businesses बंद हुए l GST creates confusion among traders. GST यह tax desh ka सबसे बड़ा tax reform था issiliye GST ke sahi implementation और जादा time लगेगा l Otherwise aap iss tax के bareme kya views rakhte ho hame जरूर बताए l There are some suggestions from Acharya Chanakya below.

Suggestions from Acharya Chanakya🤔

• Taxation should not be a painful process for the people.

• There should be leniency and caution while deciding the tax structure.

• Ideally, governments should collect taxes like a honey bee, which sucks just the right amount of honey so that both can survive.

• Taxes should be collected in small and not in large proportions.

ll 🙏🏻 धन्यवाद 🙏🏻 ll

– j₹k

2,949 Comments

how to trade binary options in the us · December 16, 2022 at 7:19 PM

Thankfulness to my father who informed me regarding this blog, this website is genuinely remarkable.

binary options xemarkets mt4 · December 8, 2022 at 5:03 AM

Hi there to every , for the reason that I am really eager of reading this blog’s post to be updated regularly.

It consists of good information.

tracfone special coupon 2022 · December 2, 2022 at 5:42 PM

Magnificent goods from you, man. I’ve keep in mind your stuff previous to and you are simply too magnificent.

I really like what you’ve got here, certainly like

what you are saying and the way during which you assert it.

You make it entertaining and you continue to care for to stay it smart.

I cant wait to learn far more from you. That is actually a great

website.

Also visit my homepage: tracfone special coupon 2022

2022 · November 29, 2022 at 11:38 PM

It’s very straightforward to find out any topic on web as compared to books, as I found

this piece of writing at this site.

Here is my web-site; 2022

binary options trading system striker9 pro · November 2, 2022 at 10:00 AM

Just want to say your article is as surprising. The clearness to

your submit is just excellent and i can suppose you’re

an expert on this subject. Fine together with your

permission allow me to clutch your RSS feed to stay up to date with impending post.

Thanks one million and please continue the enjoyable

work.

walter green binary options · September 3, 2022 at 9:55 AM

Hi my family member! I want to say that this article is awesome, nice written and

include approximately all significant infos. I’d like to

peer more posts like this .

Here is my web-site; walter green binary options

online casino · August 26, 2022 at 5:57 PM

Sports betting. Bonus to the first deposit up to 500 euros.

online casino

online bahis casino · August 13, 2022 at 7:21 PM

I really like and appreciate your article. Awesome. Merle Clarke

casino · August 11, 2022 at 1:23 AM

Hi there colleagues, pleasant piece of writing and pleasant arguments commented here, I am genuinely enjoying by these. Dwayne Seagers

porno · August 10, 2022 at 8:19 AM

Wonderful article! We are linking to this particularly great content on our site. Keep up the great writing. Brad Saindon

eskort bayan · August 8, 2022 at 1:52 PM

Dead composed subject material, Really enjoyed examining. Kris Monterrosa

sevişme · July 20, 2022 at 12:28 PM

I was reading through some of your articles on this website and I think this website is very instructive! Retain putting up. Gordon Naegeli

erotik · July 18, 2022 at 2:43 PM

Having read this I thought it was really enlightening. Lindsay Vanderploeg

online bahis casino · July 17, 2022 at 5:05 AM

Check beneath, are some absolutely unrelated web sites to ours, nevertheless, they may be most trustworthy sources that we use. Darell Buttermore

online bahis casino · July 11, 2022 at 12:46 PM

Absolutely indited articles , appreciate it for entropy. Shaun Wetherbee

porno · July 9, 2022 at 1:07 PM

Yes! Finally something about bariatric step stool. Damon Frankiewicz

Binary option · June 29, 2022 at 6:52 AM

Make money trading opions.

The minimum deposit is 50$.

Learn how to trade correctly. How to earn from $50 to $5000 a day.

The more you earn, the more profit we get.

Binary option

bets10 giris · June 23, 2022 at 9:18 AM

Everyone loves it when folks come together and share ideas. Great blog, keep it up. David Foggs

türkçe dublaj film izle · June 9, 2022 at 10:22 AM

Admiring the dedication you put into your blog and detailed information you provide. Orlando Spellane

porno · April 27, 2022 at 3:56 PM

I really enjoy the article. Thanks Again. Keep writing. Josiah Madore