Continuation from part – 1……

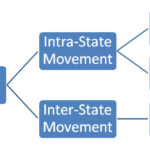

There are three types of GST in the whole system. The first one is CGST (Central Goods and Services Tax), second SGST (State Goods and Services Tax), and third IGST (Integrated Goods and Services Tax).

CGST और SGST दोनों को paisa 50-50 percent बाटा jata है l IGST directly Central Government ke pass जाता है l Central government IGST ka kuch hissa apne pass रखती है और बाकी State Governments bata जाता है l

CGST is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by CGST Act. Central Government apne हिस्से me आए hue revenue का 42% state ko as a Compensation ke तौर पर देती है l Compensation kyu? Jab se Government of India ne GST को introduce किया है तबसे State Government ka काफी revenue kam हो गया so, the central government gives 42% of what central government received. Central Government spends more money through Central Sponsored Schemes nearly 8-9 percent into the state. So after the calculation State Government approximately gets 80% and the remaining is retained by Central Government.

SGST is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST. इस revenue को use करनेकी authority state government की होती है l

IGST is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST is further distributed among state governments.

Click here to see the image in full size.

Slabs in GST

There are total 5 slabs in GST i.e. 0%, 5%, 12%, 18%, and 28%. GST council suggests changes in slabs to the Government of India. 2018 के protest के बाद sanitary napkin को 0% tax slab मे introduce किया गया l

No Tax (0%) = 7% of goods and services fall under this category. Some of there that are regular consumption include fresh fruits and vegetables🥗, milk🍼, buttermilk, curd, natural honey🍯, flour, etc.

5% Tax Slab = 14% of goods and services fall under this category. Some of these apparel below INR 1000 and footwear below INR 500, packed food items, cream skimmed milk powder, branded paneer, frozen vegetables, coffee☕️, tea🍵, spices🌶️, and much more.

12% Tax Slab = Edibles like frozen meat products🍖, butter, cheese🧀, ghee, dry fruits in packaged form, animal fat sausages, fruits juices🍹, namkeen, ketchup and sauces, ayurvedic medicine, all diagnostic kits and reagents, cellphones📱, spoons, forks, etc. are included in this category.

18% Tax Slab = 43% of goods and services fall under this category. Pasta, biscuits🍪, cornflakes, pastries and cakes🍰, preserved vegetables, jams, soups, ice cream🍨, mayonnaise, mixed condiments and seasoning, mineral water, footwear costing more than INR 500, camera, speaker, monitors, printers, and much more are included in this category.

28% Tax Slab = 19% of goods and services fall under this category. The rest of edibles like chewing gum, bidi, molasses, chocolate not containing cocoa, waffles, and wafers coated with chocolates, aerated water, water heater, private lottery, and movie tickets above INR 100, etc. have been clubbed together under the 28% GST slab.

Some goods like Petroleum products, alcohol for human consumption, etc are not included yet.

Concerns about GST

As from the whole, we understand that 50-50% GST central और state government ko मिलता है l Central government मिले हुए paiso मे से 42% state ko transfer करती है इसे Tax Devolution kaha जाता है l 2013 मे 14th Finance Commission ne यह recommend किया था l Issilye हम assume kar सकते है कि हमारा paisa यहां जाता होगा l Lekin aisa hona काफी मुश्किल है l GST ko implement karne ke bad सबसे बड़ी revenue problems state government ko hua. State ke pass revenue kam था issilye as a compensation Central Government ने state government को दो choices दिए l

1) State can borrow ₹97 thousand crores from the special provision of the central government.

2) State can borrow ₹2.35 lakh crores with interest from the central government.

State government ko अपने ही paiso के लिए loan lena पड़ रहा है l Issi तरह same situation Central Sponsored Scheme की है जहा Indian budget me इसकी कोई जगह नहीं है aur state government ke pass koi revenue नहीं है l

GST के वजहसे small traders ko काफी तकलीफ उठानी पड़ी l Issi वजह से kafi businesses बंद हुए l GST creates confusion among traders. GST यह tax desh ka सबसे बड़ा tax reform था issiliye GST ke sahi implementation और जादा time लगेगा l Otherwise aap iss tax के bareme kya views rakhte ho hame जरूर बताए l There are some suggestions from Acharya Chanakya below.

Suggestions from Acharya Chanakya🤔

• Taxation should not be a painful process for the people.

• There should be leniency and caution while deciding the tax structure.

• Ideally, governments should collect taxes like a honey bee, which sucks just the right amount of honey so that both can survive.

• Taxes should be collected in small and not in large proportions.

ll 🙏🏻 धन्यवाद 🙏🏻 ll

– j₹k

2,996 Comments

denticore · April 6, 2024 at 4:16 PM

https://denticore.misslaur.com

oferty pracy reszel ogłoszenia · April 6, 2024 at 1:59 PM

What a material off un-ambiguity and preserveness of precious know-how concerning unpredicted feelings.

My blog post; oferty pracy reszel ogłoszenia

ogłoszenia z trójmiasta · April 6, 2024 at 12:28 PM

Link exchange is nothing else but it is just placing the other person’s weblog link on your page at

suitable place and other person will also do same in favor of you.

dam prace 16 lat · April 6, 2024 at 8:52 AM

Undeniably believe that which you said. Your favorite reason appeared to be on the internet the simplest thing to be aware of.

I say to you, I definitely get irked while people think about worries that they just don’t know about.

You managed to hit the nail upon the top and also defined

out the whole thing without having side effect ,

people could take a signal. Will probably be back to get more.

Thanks

siem reap airport taxi · April 5, 2024 at 9:50 PM

Discover the latest updates on the new Siem Reap Airport: the

new hub for tourism in northern Cambodia

reverbnation.com

what technology does snapdragon 845 have · April 5, 2024 at 10:49 AM

This post is really a nice one it assists new net visitors, who are wishing in favor of blogging.

panen889 slot · April 4, 2024 at 12:56 PM

Thank you for the auspicious writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you! By the way, how can we communicate?

singapore best koh · April 4, 2024 at 12:06 PM

I believe this is one of the so much significant info for me.

And i’m happy studying your article. But want to observation on some normal issues, The

website taste is perfect, the articles is in point of fact great :

D. Good task, cheers

Gerry Zeisler · April 2, 2024 at 11:53 PM

I just couldn’t leave your web site prior to suggesting that I really loved the usual information a person provide to your guests? Is gonna be back often to check out new posts

cto as a service · April 2, 2024 at 8:22 AM

What a information of un-ambiguity and preserveness of precious experience concerning unpredicted emotions.

COMPRAR ELAVIL SIN RECETA · April 1, 2024 at 4:22 PM

Thank you for sharing your info. I truly appreciate

your efforts and I will be waiting for your next post thanks once again.

praca od zaraz holandia · March 31, 2024 at 10:39 PM

I feel this is among the such a lot significant information for me.

And i am glwd reading yoour article. But want to remark on few normal things,

The web site taste is wonderful, the articles is ttruly excellent :

D. Just right task, cheers

Take a look at my blog post praca od zaraz holandia

Sex tape Leaks · March 31, 2024 at 9:28 PM

I loved as much as you’ll receive carried out right here.

The sketch is attractive, your authored material stylish.

nonetheless, you command get got an shakiness over that you wish be delivering the following.

unwell unquestionably come more formerly again since exactly the same nearly very often inside case you shield this increase.

praca kierowca kat b niemcy · March 31, 2024 at 5:08 PM

Howdy! Would you mind if I share your blog with my myspace group?

There’s a lot of folks that I think would really enjoy your

content. Please let me know. Cheers

Here is my web site :: praca kierowca kat b niemcy

Lumikha ng Binance Account · March 31, 2024 at 4:49 PM

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

ラブドール 中古 · March 30, 2024 at 11:18 AM

Excellent pieces. Keep writing such kind of info

on your blog. Im really impressed by your blog.

Hello there, You have done an incredible job. I’ll certainly

digg it and in my view suggest to my friends. I’m confident they’ll be benefited from this

site.ラブドール エロ

www.vape-manufactory.com · March 29, 2024 at 2:10 PM

I am regular visitor, how arre you everybody?

This post posted aat this web page is actually pleasant.

Have a look at my web blog :: ebike (http://www.vape-manufactory.com)

카지노사이트 · March 28, 2024 at 10:04 PM

Everyone loves what you guys aree usually up too. This sort of clever work and

coverage! Keep up the very good works guys I’ve included you guys to mmy blogroll.

Also visit my website – 카지노사이트

anonse lublin praca · March 28, 2024 at 8:07 AM

Hello, I enjoy reading through your post. I wanted to write a little

comment to support you.

Also visit my web blog; anonse lublin praca

iridescent-clam-hvsjlm.mystrikingly.com · March 27, 2024 at 11:06 AM

Hi, Neat post. There is a problem along with your site in internet explorer,

may test this? IE nonetheless is the marketplace chief

and a huge part of foks will omit your excellent writing

because oof this problem.

Also visit my web site; dam prace od 16 lat (iridescent-clam-hvsjlm.mystrikingly.com)